-

Where comfort meets

performance in Vaca Muerta

Integrated workforce lodging for Argentina’s energy hub – delivering predictable cash flows and aligned upside for global investors.

The Opportunity

Argentina’s energy hub is booming

Vaca Muerta is home to the world’s 2nd-largest shale gas reserve, with 72 trillion cubic meters, and the 4th-largest shale oil reserve, with 27 billion barrels of oil.

As of July 2025, production surpassed 508,000 barrels per day — a 26% year-on-year increase — and is on track to reach 1 million barrels per day by 2030.

Gas production has reached 83 million m³/day, representing 22% year-on-year growth.

In October 2025, YPF and Eni signed a landmark 20-year LNG agreement worth up to USD 15 billion annually, expected to generate over 50,000 additional jobs. Shell is finalizing its participation, which could expand total capacity by further 50%.

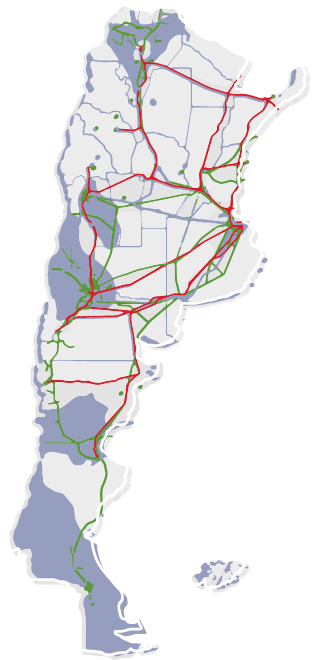

Major infrastructure investments

supports growth

In recent years, billions of dollars have been invested in infrastructure to support Vaca Muerta’s development, transforming it into a world-class energy hub.

Large-scale, export-oriented projects — including pipelines, processing plants, and port terminals — are designed to move energy efficiently from the basin to global markets.

These investments, led by both the public and private sectors, not only ensure sustained production growth but also reinforce the region’s strategic role as Argentina’s primary energy export base.

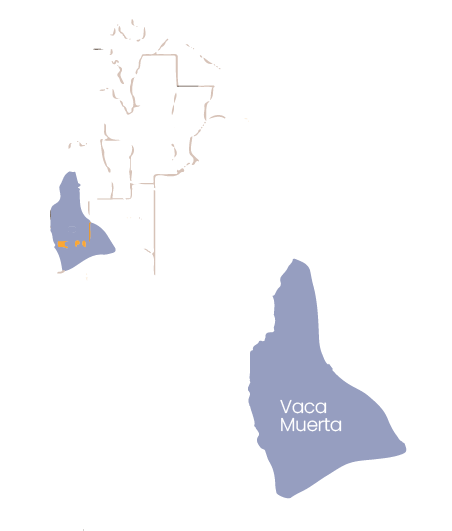

Location

Advantage

Añelo — known as “the capital of Vaca Muerta” — is strategically located between production fields and Neuquén City: 15–30 minutes from major shale fields, and 1.5–2 hours from Neuquén City.

This makes Añelo the main operational hub for daily logistics, guaranteeing long-term demand driven by the continuous operations of the energy sector.

It is the last urbanized point before the open desert, directly adjacent to the most productive fields.

Demand drivers

& worker influx

Global energy majors — including YPF, Chevron, Shell, and Vista — continue to deploy multi-billion-dollar investments across Vaca Muerta.

Each new drilling campaign, pipeline, or processing facility brings an influx of engineers, technicians, contractors, and service providers.

This results in a constant rotation of thousands of workers on shift cycles, many requiring long-stay accommodations near the fields.

With production growth tied to Argentina’s export-driven strategy, demand for quality lodging is expected to remain structurally high for decades.

Undersupply

of quality accommodation

While new accommodations have emerged in Añelo, most remain small, overcrowded, with no amenities and limited services for long rotations.

Common complaints include security, noise, and inadequate maintenance — revealing that most facilities were built to maximize construction margins rather than to enhance quality of living for long-stay workers.

As a result, existing lodging options fail to meet the expectations of the modern energy workforce. At the same time, total capacity remains significantly below demand. Reports indicate that rooms are “almost always full,” forcing many workers to commute daily from Neuquén, a costly inefficiency that directly impacts operational productivity and worker wellbeing.

This structural undersupply creates a high-visibility opportunity for purpose-built, long-stay accommodations that combine comfort, operational efficiency, and sustainability — a rare instance where demand is locked in by energy players, yet quality supply is years behind.

The Project

Aiken Haus is a modular, scalable, and sustainable long-stay lodging complex designed for workforce comfort and Operational Efficiency in the heart of Vaca Muerta

20 modular cabins

- 120 rooms

Fully equipped single and double rooms with private bathrooms, designed for long-stay comfort

Club House

Dining, recreation, and social areas that support well-being and community

Operational

Efficiency

Integrated services including 24/7 security, cleaning, laundry, and catering (on-site and take away)

Investment case

6.5M USD

Total investment

6.5 years

Payback period

~21%

Target IRR (5 years)

81% base case

Occupancy assumption

16%

Annual cash return

100K USD

Minimum investment

10%

Preferred return

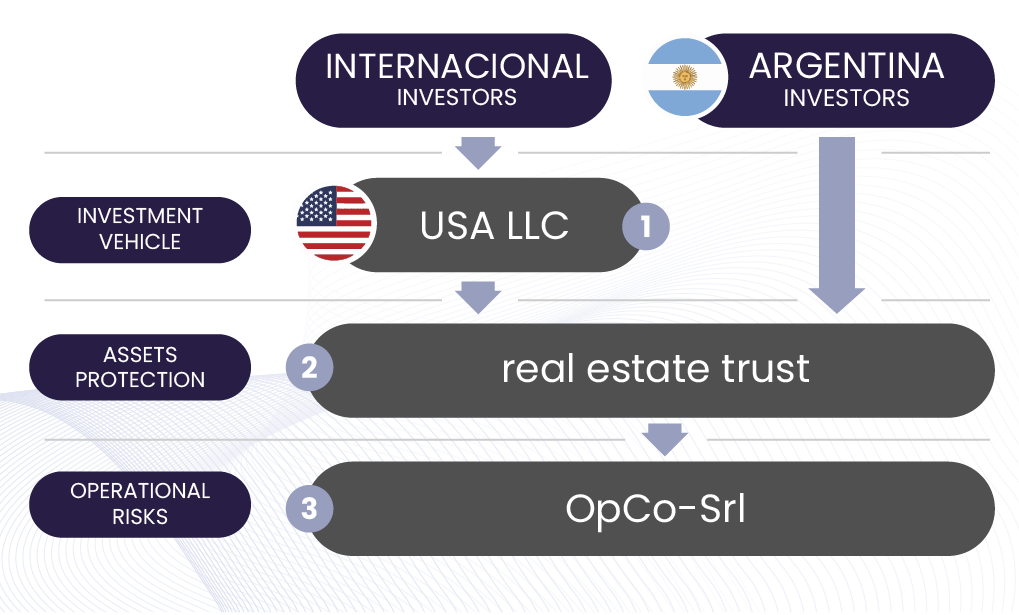

Legal and Governance Framework

Aiken Haus is structured through an internationally recognized framework designed to protect investor capital, ensure operational transparency, and separate ownership from day-to-day management.

1.  U.S. LLC — International investors

U.S. LLC — International investors

entry vehicle ensuring transparent governance

2.  Argentine Real Estate Trust (Fideicomiso Inmobiliario)

Argentine Real Estate Trust (Fideicomiso Inmobiliario)

Holds and manages all project assets on behalf of all investors

3.  Local Operating Company (OpCo)

Local Operating Company (OpCo)

Operates the property and manages daily hospitality activities

This information outlines Aiken Haus’s organizational structure for transparency purposes. It does not constitute legal or investment advice.

Team Involved

Francisco

Jurado

Desarrollador / Gestión

Experiencia en la creación y gestión de empresas en múltiples sectores

linkedin.com/alexandra-roy

Francisco

Jurado

Desarrollador / Gestión

Experiencia en la creación y gestión de empresas en múltiples sectores

linkedin.com/alexandra-roy

Francisco

Jurado

Desarrollador / Gestión

Experiencia en la creación y gestión de empresas en múltiples sectores

linkedin.com/alexandra-roy

Francisco

Jurado

Desarrollador / Gestión

Experiencia en la creación y gestión de empresas en múltiples sectores

linkedin.com/alexandra-roy

Additional supporting roles

Legal, tax, accounting, local operations team.

faqs

What is Aiken Haus?

Aiken Haus is a long-stay accommodation project designed to support workforce mobility in the Vaca Muerta region. It provides comfortable housing, services, and a community environment for operational staff and professionals working on rotation schedules.

The project is structured as the first pilot of a scalable platform that can be replicated across other strategic regions with similar housing demand characteristics.

What stage is the project currently in?

The project has completed concept development, design definition, and financial modelling. Engineering plans and operational structures are established. Aiken Haus is currently formalizing strategic investment partnerships for construction and launch.

What problem does Aiken Haus solve?

Accommodation supply in Vaca Muerta is structurally limited and often inconsistent in quality and service reliability. Workers are frequently housed in temporary or suboptimal facilities, affecting well-being and retention. Aiken Haus offers a purpose-built, professionally managed alternative that improves living standards and operational predictability for companies.

What is the business model?

The primary revenue stream comes from long-stay room leasing to corporate clients.

Additional recurring revenue is generated through on-site catering services (dine-in & takeaway meal plans) and laundry services.

This integrated services model increases revenue density per guest and improves operational efficiency.

Who are the target clients?

Energy operators, service companies, EPCs, logistics firms, and other organizations with teams working in the Vaca Muerta basin under rotation or long-duration assignments.

How is the project operated?

A dedicated on-site management team oversees day-to-day operations, maintenance, services, and guest experience. Core services—security, catering, cleaning, and laundry—are delivered through coordinated vendors under centralized management protocols to maintain cost efficiency and service consistency.

How does Aiken Haus manage operational efficiency?

Centralizing services and standardizing facility operations reduces overhead and ensures predictable cost structures. This approach enhances reliability and simplifies contract negotiations for corporate clients.

What is the expected investment profile?

The project is structured to generate stable recurring cash flows through contracted occupancy and integrated service revenues.

Downside protection is supported by delivering a superior and reliable service level, positioning Aiken Haus as the preferred provider relative to fragmented local alternatives. This service differentiation encourages corporate clients to maintain long-term agreements even under varying activity cycles.

contact